The MyMilestoneCard can be a helpful tool for individuals seeking to improve or rebuild their credit scores. MyMilestoneCard is a credit card offered by Genesis Financial Solutions. It is a tool to help rebuild credit, offering a convenient and secure way for cardholders to make purchases, track spending, and manage payments.

Milestone card is a non-secure credit card that users can use to increase their credibility, according to the official MyMilestoneCard login. People often start with a $300 credit limit per card, but once approved, the brand will determine your credit limit based on your current profile.

Why Do You Need the MyMilestoneCard CC Login Portal?

The MyMilestoneCard login portal provides cardholders with an easy and secure way to access their accounts online. The portal is essential for customers who have a Milestone Gold Mastercard or a similar Milestone credit card. Here are the main reasons why you would need to access the portal:

- View Account Balance: See how much is owed on the card.

- Make Payments: Pay off credit card balances directly through the website.

- Check Transaction History: Review recent purchases and payments.

- Request Credit Limit Increase: Request to raise the credit limit once the cardholder’s creditworthiness improves.

- Set Up Alerts: Set up email or text message alerts for due dates, balance reminders, and more.

- Update Personal Information: Change personal details, such as your address, email, or phone number.

- Access Customer Support: Contact the support team for help with account issues or questions.

MyMilestoneCard login portal helps streamline the management of your Milestone card by offering easy access to a range of features, including payments, rewards, statements, and more.

Eligibility Criteria for Milestone Credit Card Login

Here’s a simple and easy guide to the eligibility for the MyMilestoneCard:

- Age: You must be at least 18 years old.

- Social Security Number (SSN): You need to be a valid Social Security Number (SSN) or ITIN.

- Credit History: The card is for those with bad or no credit. You can still qualify even with poor credit.

- Income: You may need to show proof of income to ensure you can make payments.

- Address: You must have a U.S. mailing address.

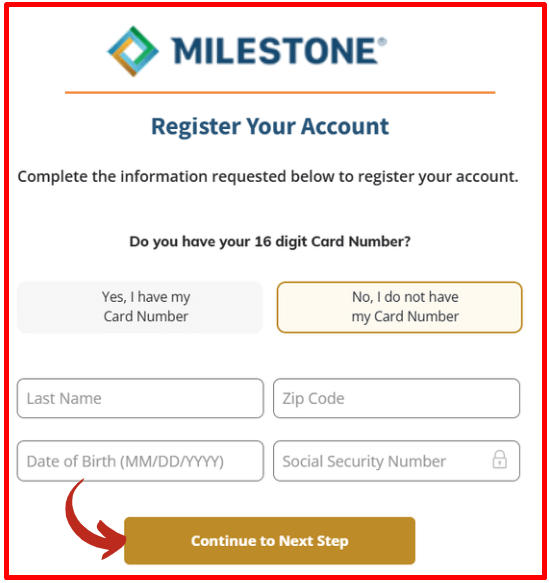

MyMilestone Card Registration – Create an Account

Here’s a simple and easy guide to registering for MyMilestoneCard:

- Visit the Website: Go to MyMilestoneCard.com.

- Click on Register: Look for the “Register” or “Sign Up” button on the homepage.

- Enter Card Details: Provide your Milestone credit card number and other personal details.

- Enter Personal Details: Fill in your personal details such as your name, date of birth, and the last four digits of your social security number.

- Create Login Info: Create a User ID and password for your account.

- Agree to Terms: Read and accept the terms and conditions.

- Submit: Click “Submit” to complete registration.

- Access Your Account: Log in with your User ID and password to manage your card.

That’s it! You’re all set to manage your Milestone Credit Card online.

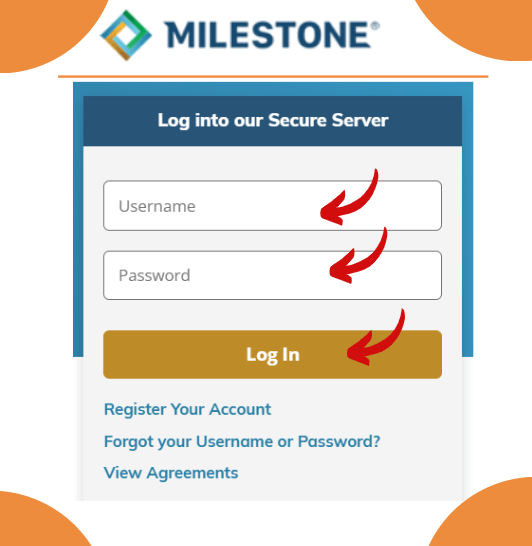

MyMilestoneCard Login Process

Logging into your MyMilestoneCard account is quick and simple. To access your account, follow these simple steps:

- Visit the Website: Open your web browser and go to MyMilestoneCard.com.

- Click on the Login Button: On the homepage, you’ll see a “Login” button. Click on this to proceed.

- Enter Your Login Credentials

- User ID: Enter the User ID that you created during registration.

- Password: Type in the Password associated with your account.

- Click Log In: After entering your details, click the “Log In” button to access your account.

- Manage Your Account: Once logged in, you can manage your Milestone Credit Card account by checking balances, making payments, viewing statements, and more.

With these simple steps, you can quickly and securely access your MyMilestoneCard account to stay on top of your finances.

If you forget your login credentials, you can use the “Forgot User ID” or “Forgot Password” options on the login page to reset your information.

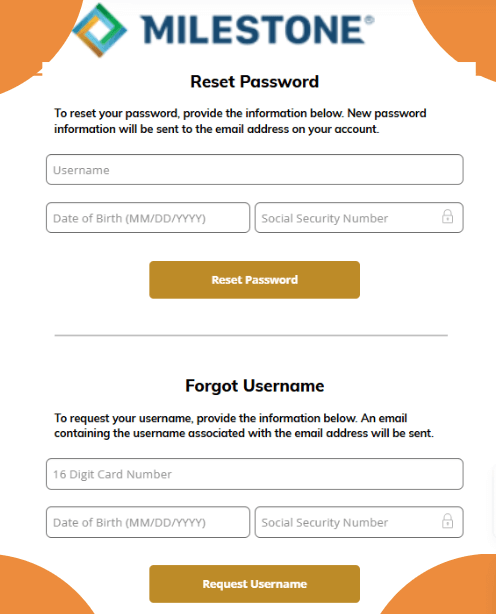

How to Reset Forgot Password

To reset your Milestone cc login details (User ID or Password), follow these simple steps:

- Visit the Website: Go to MyMilestoneCard.com.

- Click “Login”: On the homepage, click on the “Login” button.

- Select “Forgot User ID” or “Forgot Password”:

- If you forgot your User ID, click “Forgot User ID.”

- If you forgot your Password, click “Forgot Password.”

- Follow Instructions:

- For User ID: Enter your card number and SSN or ITIN.

- For Password: Enter your User ID and email address.

- Reset: Follow the steps to reset your credentials, and you’ll receive instructions via email.

- Log In: Use your new details to log in!

That’s it! You’ve successfully reset your MyMilestoneCard login details.

Activate MilestoneCard – Easy Methods

To activate your Milestone Gold Mastercard, follow these steps:

1. By Phone:

- Call the Activation Number: Look for the sticker on your card. It will have a toll-free number (typically something like 1-800-645-6703).

- Follow the Prompts: The automated system will ask you for your card number, personal information, and the last four digits of your SSN.

- Once you provide the required info, the system will confirm that your mymilestone card is activated.

2. Online:

- Visit the Website: Go to MyMilestoneCard.com.

- Log in: If you already have an account, log in using your User ID and Password. If you don’t have an account yet, you may need to register first.

- Activate Your Card: Look for the Activate Card option and follow the instructions.

3. Confirmation:

- After activation, you’ll receive a confirmation (either via phone or online), and your card is ready to use.

Make Payments Using Milestone Gold Mastercard

Once registered, you can make payments easily:

- Log in to your account.

- Click on “Payments.”

- Select “Make a Payment.”

- Enter payment details and confirm the amount.

- Click “Submit Payment.”

Features of mymilestonecard.com

Here are the simple and easy features of the MyMilestoneCard:

- Build or Rebuild Credit: Helps improve your credit score by reporting payments to credit bureaus.

- Credit Limit: Provides a credit limit for purchases.

- Online Account Management: Easily manage your account online (check balances, make payments, view statements).

- Monthly Reporting: Payment activity is reported to the major credit bureaus.

- Low Annual Fee: It has an affordable annual fee.

- No Security Deposit: You don’t need to pay a deposit to get the card.

- Fraud Protection: Offers security features to protect your account.

- Credit Limit Increases: You can qualify for higher credit limits with responsible use.

How to Use Your MyMilestoneCard

You can use your MyMilestoneCard anywhere major credit cards are accepted. Here’s where you can use it:

- In-Store Purchases:

- Use it at retail stores, supermarkets, or any shop that accepts Visa or Mastercard (depending on the card type).

- Online Shopping:

- Use it for e-commerce purchases on websites like Amazon, eBay, or any online store that accepts credit cards.

- Bill Payments:

- Pay your utilities, subscriptions, and other monthly bills online or through bill payment services.

- Travel and Hotels:

- Book flights, hotels, and car rentals as most travel companies accept credit cards.

- Restaurants and Cafes:

- Pay for meals at restaurants, cafes, and food delivery services.

- Gas Stations:

- Fill up your car at gas stations that accept credit card payments.

Basically, you can use your MyMilestoneCard anywhere that accepts Visa or Mastercard for payments.

Lost Your Milestone Card – Check this Guide

If you’ve lost your MyMilestoneCard, here’s what to do:

- Call Customer Service: Contact 1-800-645-6703 immediately to report the lost card.

- Freeze the Card: Customer service will help you block the card to prevent unauthorized use.

- Request a Replacement: Ask for a replacement card to be sent to you.

- Monitor Your Account: Keep an eye on your account for any unauthorized charges and report them.

About MyMilestoneCard

The MyMilestoneCard, or Milestone Gold Mastercard, is a credit card designed for people who want to improve and control their credit. It is offered by the Bank of Missouri and Concora Credit Inc. (formerly known as Genesis Financial Solutions), both reputable organizations in finance.

This bank started as the Bank of Perryville and was the only bank in Perry County, Missouri. In 1997, it grew and changed its name to the Bank of Missouri. Today, it has more than 20 branches in different places, offering dependable banking services to its customers.

Concora Credit Inc. is a company in the U.S. that focuses on providing banking services for customers. It specializes in assisting people with low or limited credit scores to improve their financial standing. Genesis FS offers new credit goods and services that help cardholders improve their credit profiles and develop better financial habits.

MyMilestone Customer Service

Here are the contact details for MyMilestoneCard:

Customer Service Phone Number:

- 1-800-645-6703 (for general inquiries, reporting lost cards, and account support)

Mailing Address for Payments:

- Milestone® Mastercard® P.O. Box 84064 Columbus, GA 31993-4064

Online Support:

- Visit the official website: MyMilestoneCard.com for online account management, FAQs, and customer service options.

FAQs

How do I apply for the MyMilestoneCard?

- You can apply for the MyMilestoneCard online at MyMilestoneCard.com.

What is the annual fee for the MyMilestoneCard?

- The annual fee typically ranges based on your creditworthiness but is generally affordable for those with limited credit.

Can I use the MyMilestoneCard anywhere?

- Yes, you can use the MyMilestoneCard anywhere that accepts Visa or Mastercard, both online and in-store.

How do I check my balance on MyMilestoneCard?

- You can check your balance by logging into your online account, or by calling customer service.

Can I get a replacement card if mine is lost or stolen?

- Yes, you can contact customer service immediately to report the loss and request a replacement card.

How is the MyMilestoneCard different from a secured credit card?

- Unlike a secured card, the MyMilestoneCard does not require an upfront deposit.

What happens if I miss a payment on MyMilestoneCard?

- Missing a payment may lead to late fees, and it can negatively affect your credit score.

How can I redeem rewards or benefits?

- MyMilestoneCard does not typically offer traditional rewards programs, but some benefits may be available depending on the card type and usage.

Can I get a cash advance with MyMilestoneCard?

- Yes, you can obtain a cash advance with MyMilestoneCard, but there may be additional fees and higher interest rates.

How can I close my MyMilestoneCard account?

- To close your account, contact customer service and ensure your balance is paid off in full. Be sure to get written confirmation of the closure.

Contents

- 1 Why Do You Need the MyMilestoneCard CC Login Portal?

- 2 Eligibility Criteria for Milestone Credit Card Login

- 3 MyMilestone Card Registration – Create an Account

- 4 MyMilestoneCard Login Process

- 5 How to Reset Forgot Password

- 6 Activate MilestoneCard – Easy Methods

- 7 Make Payments Using Milestone Gold Mastercard

- 8 Features of mymilestonecard.com

- 9 How to Use Your MyMilestoneCard

- 10 Lost Your Milestone Card – Check this Guide

- 11 About MyMilestoneCard

- 12 MyMilestone Customer Service

- 13 FAQs